PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

A 2022 Rate Hike?

This month’s FTxIGM US Macroeconomists Survey looks at a 2022 interest rate hike. It also examines a timeline for when the FOMC might begin tapering of its purchases of Treasuries and mortgage-backed securities.

Summary

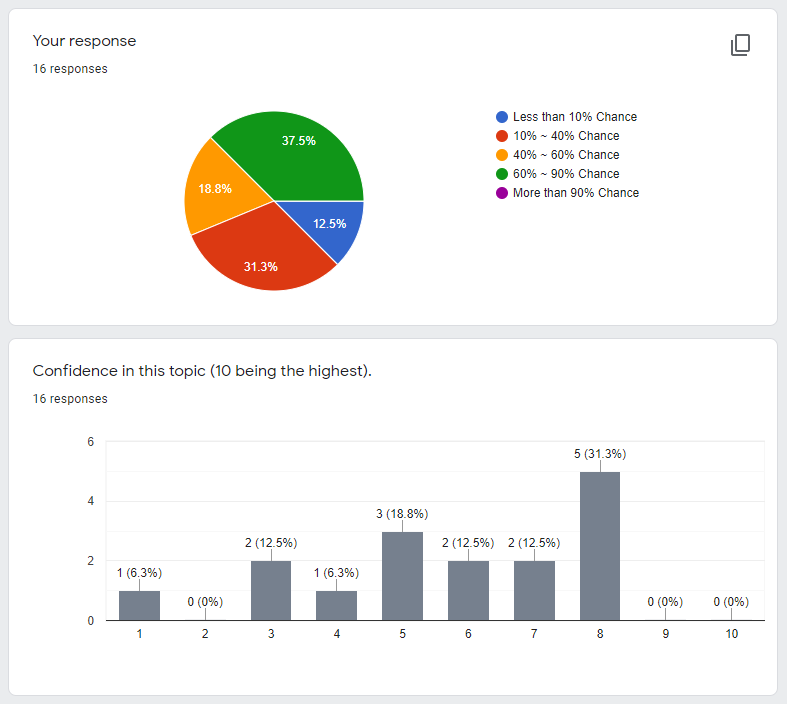

Compared to the macroeconomist surveys, the PhD students attached a lower probability to the likelihood of core PCE inflation exceeding 2% per annum in the year ending December 2022. While 58% of the macroeconomists placed more than 60% chance, only 37.5% of the PhD student responses did. No PhD student attached a more than 90% chance, while 20% of the macroeconomists did.

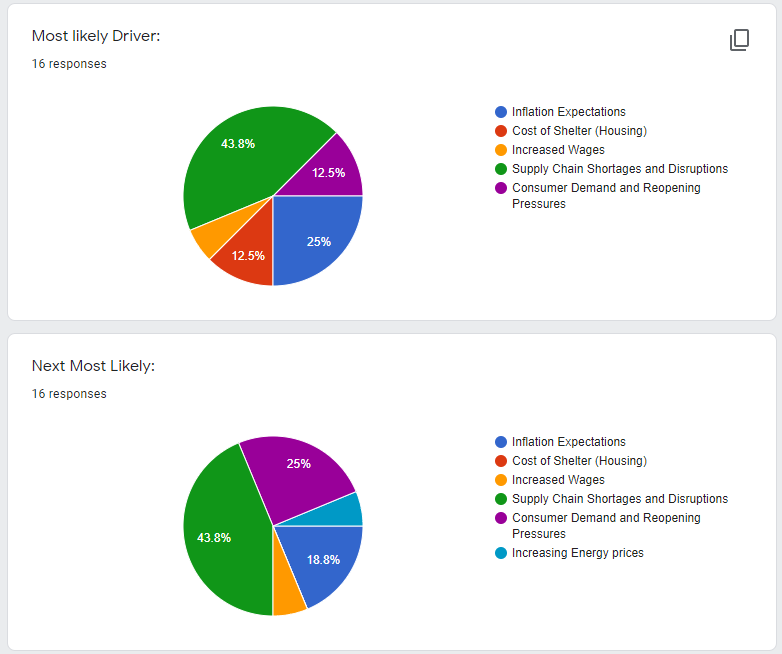

While the probability assessments differed across the two groups, both cited supply chain issues as the most likely driver of upside inflation risk between now and end of 2022. However, the macroeconomists seemed to place more emphasis on consumer demand and reopening pressures, while the PhD students gave more weight to inflation expectations.

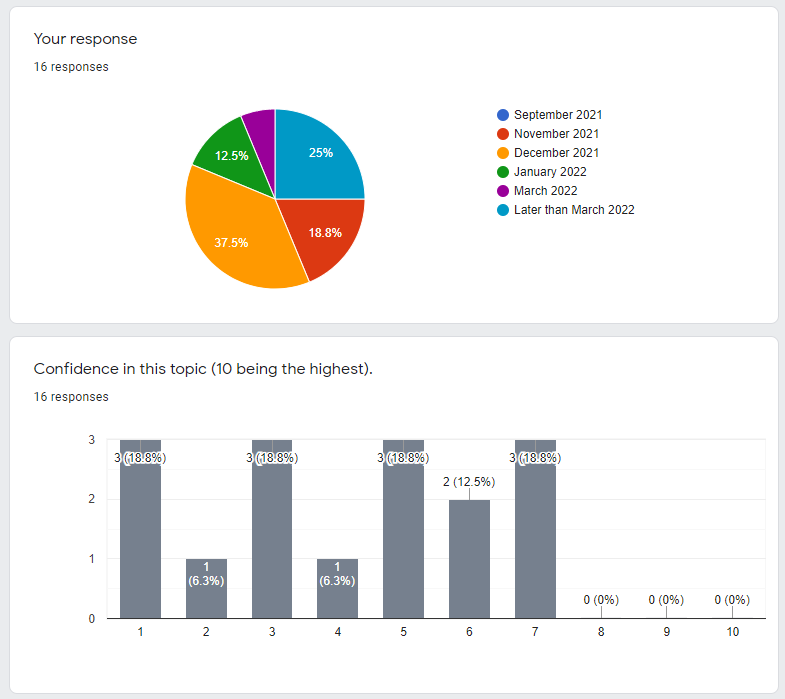

With respect to the timing of the FOMC announcing the beginning of tapering, the macroeconomists guessed November 2021 as their top choice (48%) while the PhD students chose December 2021 as their top choice (37.5%).

Question A

“What is your estimate of the likelihood that core PCE inflation will exceed 2% per annum in the year ending December 2022, i.e. 2021 December/2022 December?”

Select Explanations

-

Shortages seem to get more persistent. The Fed will have incredible pressure not to raise rate before the midterms/renewal of Powell’s mandate. Raising rates could end up very costly giving the high asset prices. Inflation expectations are getting unanchored in Germany. AIT also calls for slow response to inflation. The big questions is if higher than 2% is good or not?

-

Inflation has been rising steadily, and there is the concern that the COVID recovery will “overcorrect” (though perhaps not an issue), and inflation will therefore be higher than typical. However, my feeling is that the Fed is increasingly able to tame inflation effectively both with standard and newer policy tools (like transparent and frequent communication), therefore it they will aggressively bring down inflation if needed. And 2% would fall into the needed category.

-

This isn’t just to do with low rates / monetary policy - the supply crunch is going to drive prices up. Look at the timber and chip shortages or the super lower inventory to sales ratio.

-

Required to inflate down the value of business debt.

-

Median wages increasing + energy prices increasing + long-lasting disruptions of supply chains

-

Supply is still heavily constrained for large sections of PCE due to common upstream inputs (eg semiconductors for motor vehicles). Will be difficult for pricing to remain in check given this

-

Currently YoY for core PCE is ~3.5%. The Fed is beginning to taper, which should reduce the level of money in the economy, and then lead less inflation. Further, that also leads to rising interest rates and given the government debt, the treasury needs to sell more bonds to roll over the accumulating interest and this once again removes cash/money in the economy (assuming there are buyers - as always). All these signs point that things are going down, but going from 3.5% to 2% YoY is still a huge leap.

-

I haven’t really given this much thought, also I believe I lack background to answer this question with 90% or higher confidence.

Question B

“Which of the following factors do you think are the two most important drivers of upside inflation risks between now and the end of 2022?”

Question C

“When do you expect the FOMC to formally announce the beginning of tapering of its purchases of Treasuries and mortgage-backed securities?”

Select Explanations

-

Jackson’s Hole seems to have given a relatively clear signal, but the slow job growth in August might delay at least slightly the tapering.

-

Powell has made statements to the effect that they will be slow to reel back their purchasing policies, and I’m guessing that, if anything, they will start the undoing after they feel it is “safe”. So quite late.

-

My guess is year over year numbers will look especially strong comparing this holiday season to the last, thus giving the fed a good moment to hike rates.

-

a signal was given that this will begin soon in September notes. But it is unclear to me when exactly this will occur given Fed’s leniency for inflation to overshoot 2% in an effort to catch up on previous low inflation. Low confidence.

-

2022 is a midterm election year and tapering imposes downward pressure on the stock market as well as on inflation. The latter might be more relevant for more “local” elections.