PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

Crypto Assets

Summary

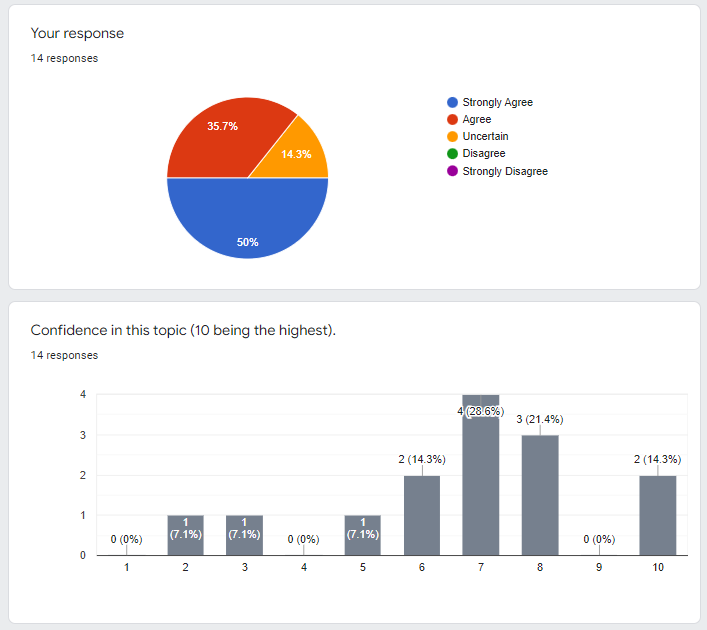

Both the experts panel and the PhD respondents agree that the volatility in crypto prices reflect the movements in investor sentiment as opposed to news about fundamental value.

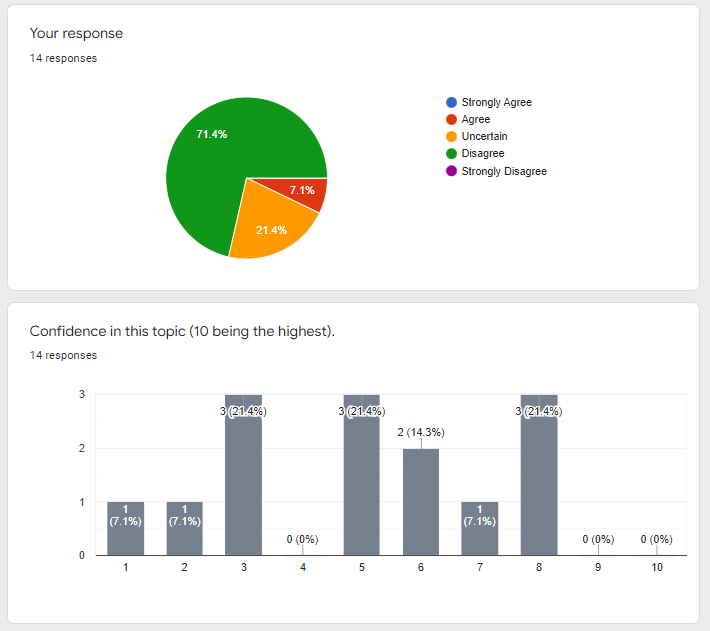

The two set of respondents diverged on whether crypto assets pose significant risk to financial stability. 72% of the PhD respondents disagreed with 21% uncertain, while only 9% of the experts panel disagreed. On the other hand, 37% of the experts panel agreed, citing relation to climate risk (Acemoglu) and the lack of regulation (Duffie) as reasons. Only 9% disagreed and thought it did not pose a significant risk.

Question A

High volatility in the prices of crypto assets such as Bitcoin, Dogecoin, and Ethereum largely reflects movements in investor sentiment rather than news about potential sources of fundamental value (such as possible applications, or use in illicit transactions).

Select Explanations

- Ethereum has value, but Doge does not. So Doge is largely about sentiment but Eth much less so. Bitcoin is somewhere in the middle.

- Cryptocurrencies do not function as currencies, but rather as speculative investments. By convincing others that they have fundamental value, early adopters stand to profit at the expense of late adopters. Essentially a Ponzi scheme.

- What fundamental value? there some central bank backing doge I haven’t heard of?

- Fundamentals don’t change so much so quickly.

- Don’t know about future prospect, but the price volatility seems to exceed the speed of improvement in transactional convenience.

Question B

Given existing regulation of the financial system, as crypto assets grow in value and become more connected to the rest of the system, the fluctuations in their valuations will pose a serious risk to financial stability in advanced economies.

Select Explanations

- Depends on who holds them. I’d imagine it’s mostly swashbucklers.

- There’s a limit to how much they can grow in value without being integrated to real world assets, at which point volatility will go down.

- Frankly, if they “became more connected to the rest of the system”, they might actually serve a tangible purpose, unlike currently. This might decrease volatility due to their valuation being less speculative in nature.

- Cryptos that aren’t functional as money will get beat out by cryptos that are (or just like, the dollar or euro).

- Still a very low share of global transactions. No one will get debt in these currencies either.

Question C

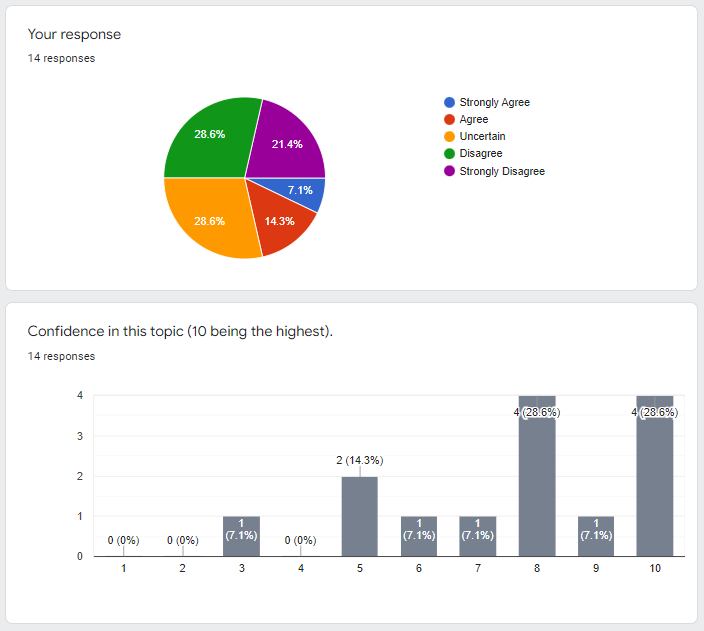

Private unbacked crypto assets serve no important economic purpose.

Select Explanations

- What do you mean by private? Many crypto assets on public blockchains are just securities that happen to be managed on a public ledger.

- In their current form, no. Investors seem to confuse the potential for economic purpose with actual economic purpose. Bitcoin, for example, is a deeply flawed implementation of a cryptocurrency, but it is not short of investors.

- Vague question, but clearly if they served no economic purpose, no one would be trading them. Perhaps they allow information asymmetry to be leveraged, or allow for speculative investment in a “fun” way for some people.

- In a larger sense, they may someday be seen as a good example of why central banks are so important, in that an unregulated currency may just never be stable enough to compete with a regulated one. I’m optimistic they may serve some purpose someday.

- Complete markets are good!