PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

Ukraine

Summary

Regarding the impact of sanctions on Russian economy, both panels generally agreed that it will lead to a recession in Russia. Regarding the impact on the European economy and the future of the dollar hegemony, both panels expressed great uncertainty.

We see some divergence regarding the global impact of Russain invasion of Ukraine. The experts panel tended to agree more that it will noticeably reduce global growth and raise global inflation than did the PhD panel.

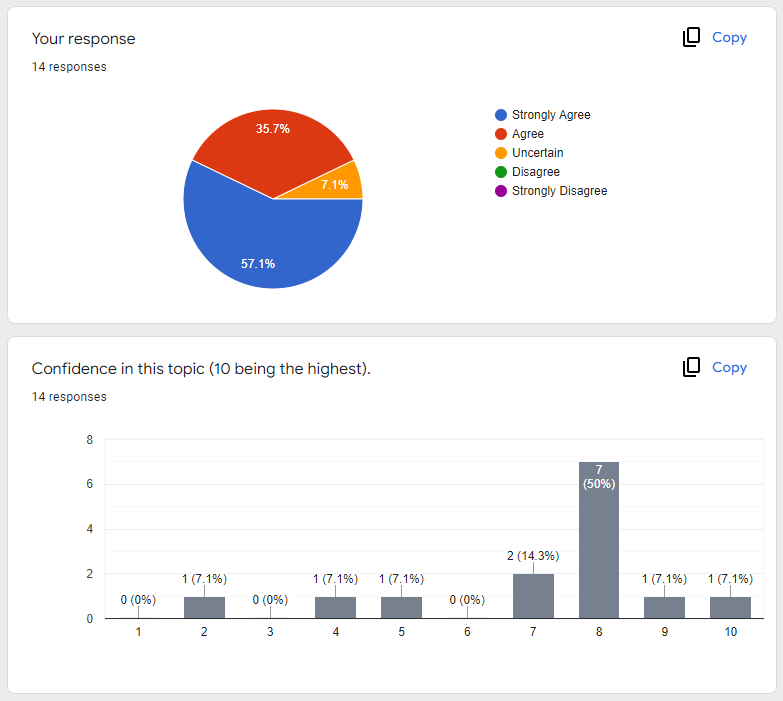

Question A

The fallout from the Russian invasion of Ukraine will be stagflationary in that it will noticeably reduce global growth and raise global inflation over the next year.

Select Explanations

- Inflation – yes, not sure about the growth, bc know little about the role of gas in industry (seems that gas prices are a bigger concern now)

- Greater defense spending could boost GDP. COVID in China is also a concern.

- Energy and Commodities are inputs to a lot of industries.

- I’m optimistic that substitution away from Russian imports, even in the short/medium run, will dampen the negative effects, globally speaking. This substitution channel seems to be the important one argued in the working paper on this topic by Ben Moll et al.

- The Russian economy is small and mostly dependent on oil. Biggest risk seems to be the wheat shortage which could cause famines in Africa and the Middle East, with potential for further consequences.

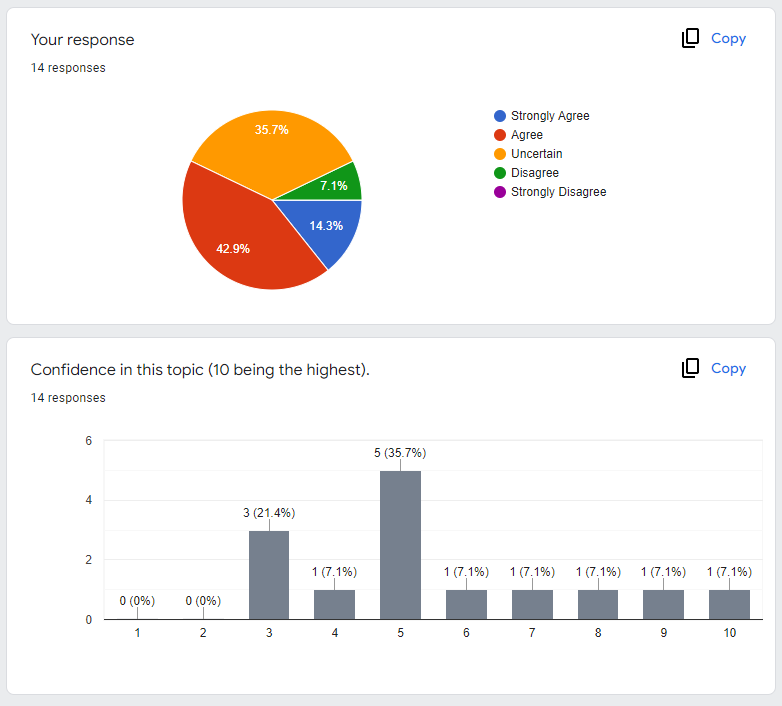

Question B

The economic and financial sanctions already implemented will lead to a deep recession in Russia.

Select Explanations

- Currency fall –> 20% inflation , fall in c and i. Employment shock from companies leaving -> further decline in income

- Putin is unpredictable. If Russian pulled out today, I’m not sure how deep the recession would be. If he carries on to the point of collapsing the financial system (increasingly likely) then deep recessions seems a natural consequence.

- They had to shut down their main plant for tanks because of missing intermediates. Since tanks will have a high importance, this speaks to the severity of sanctions. There’s also an erosion of trust with seizing of Western assets.

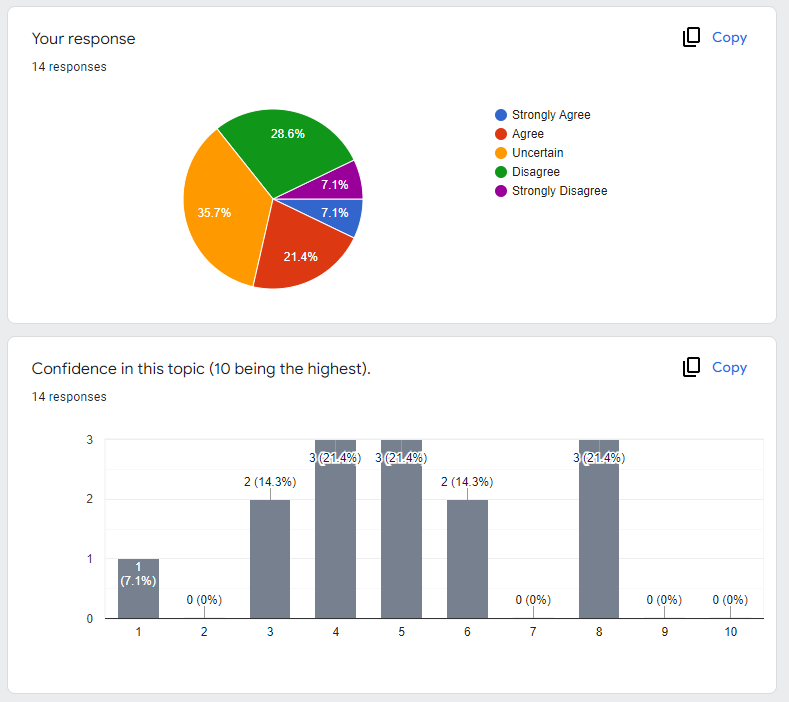

Question C

Targeting the Russian economy through a total ban on oil and gas imports carries a high risk of recession in European economies.

Select Explanations

- Recession seems a likely adjustment side effect while the energy market reconfigures

- Baqaee et al say the impact will be small. Investment in new infrastructure would help.

- In the short term, not in the long term.

- I would wager there is a high risk or recession from this policy, but it might be quite mild in countries. Clearly the magnitude of the recession is more important than just the sign, and a high risk of a low-cost event may carry different considerations than a low risk or a high-cost event.

- 1973

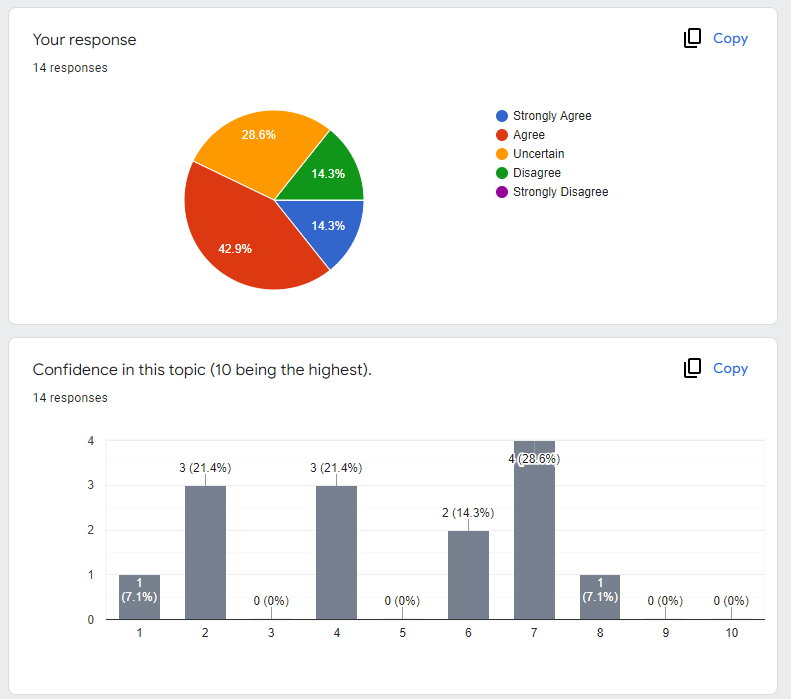

Question D

Weaponizing dollar finance is likely to lead to a significant shift away from the dollar as the dominant international currency.

Select Explanations

- Don’t know much about the topic. Have a feeling that there’s already been a trend in moving away from dollar (for other reasons)?

- The dollar is being used against bad actors. Other currencies eg RMB have exposure to arbitrary seizure.

- It’s very hard to move from that euqilibrium.

- If the weaponization is successful, is the power of the dollar not proven, or even strengthened as a threat, on the global stage? If the weaponization fails, then the dollar is merely revealed to be already weak?

- I’d assume that Russia develops substitutes in the long run. It already wants oil (or gas?) to be paid in Rubles. There’re existing contracts for now. But in the long run, I would imagine that Russia can insist on being paid in rubles. Not sure if it will be incentive compatible in the long run for Russia though.