PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

Stablecoins

Summary

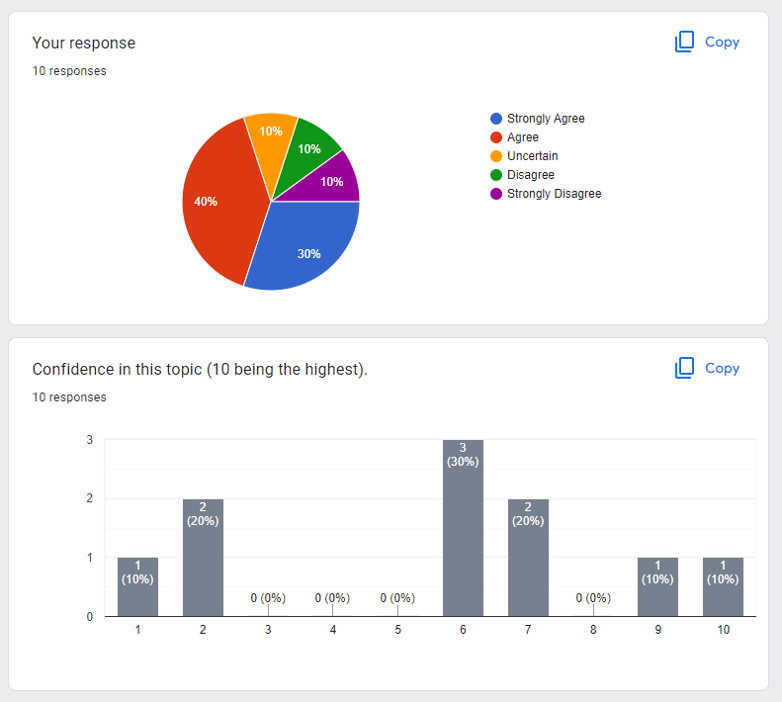

- Majority of respondents both among IGM experts (81%) and PhD respondents (70%) agreed that stablecoins are inherently vulnerable to runs. The IGM experts generally had more confidence in their responses compared to the PhD respondents.

- Note the following responses from select experts:

- Richard Thaler: “Eric Budish has convinced me this is true in theory, and recent events suggest it is true in practice.”

- Robert Shimer: “The only other way to avoid vulnerability to runs is treasury guarantees, but that defeats the purpose of stable coins.”

- Anil Kashyap: “Should be called unstable coins, they have the same design flaws as MMMFs.”

- Robert Hall: “Wrong. Less stable backing can be overcome by additional backing; e.g. bonds backed by enough sub-prime mortgages can be AAA.”

Question A

Stablecoins that are not fully backed by either central bank reserves or government securities with minimal price volatility are inherently vulnerable to runs.

Select Explanations

- Not a macro person, but I thought this is one of two reasons why we have central banks? The other reason being that technological constraints historically made broad distribution of a uniform currency extremely difficult to anybody but a monopolist such as a central bank, leading to a large number of fragmented and localized currencies (e.g., in the early colonial U.S.). Interestingly, the internet has removed this second technological constraint.

- Well-designed algorithmic stablecoins based on other cryptocurrencies should be able to withstand runs as long as the underlying cryptocurrency doesn’t completely lose value.

- Dollar pegged stablecoins are just bank deposits. They can be backed with secured loans

- Consider some of the classic banking models with a “good” (stable) and “bad” (bank run) equilibrium. We typically think providing some method of insurance against runs (e.g. FDIC) will kill the bad equilibrium. It is unclear that such an insurance mechanism exists for stable coins, in which case the “bad” case cannot be ruled out.