PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

Public and Private Equities

Summary

- Most of the IGM experts did not express strong opinions in this poll for both questions.

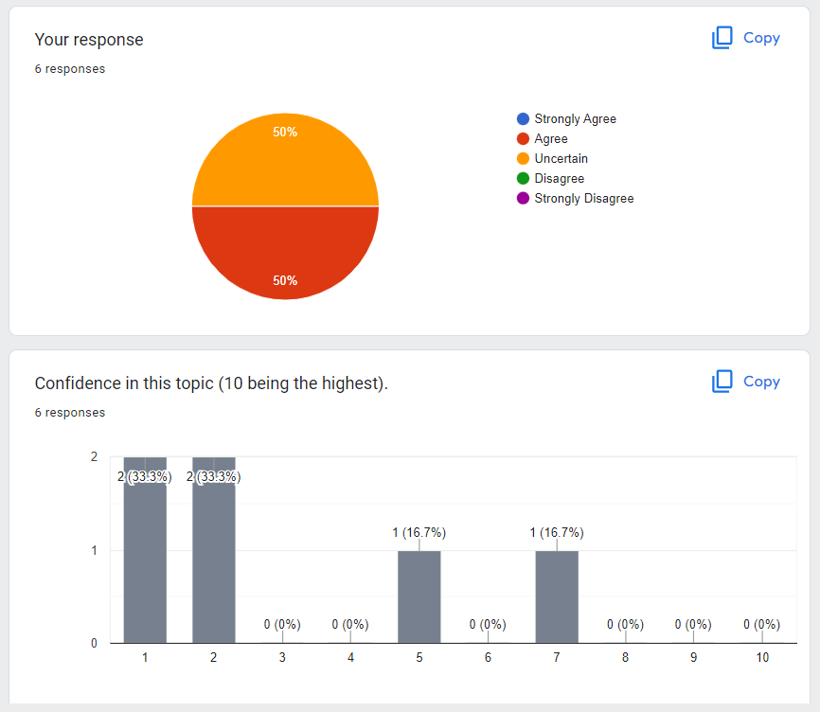

- For the first question, which asks if the true volatility of private assets is comparable to that of public assets, half of the PhD respondents were uncertain about this question.

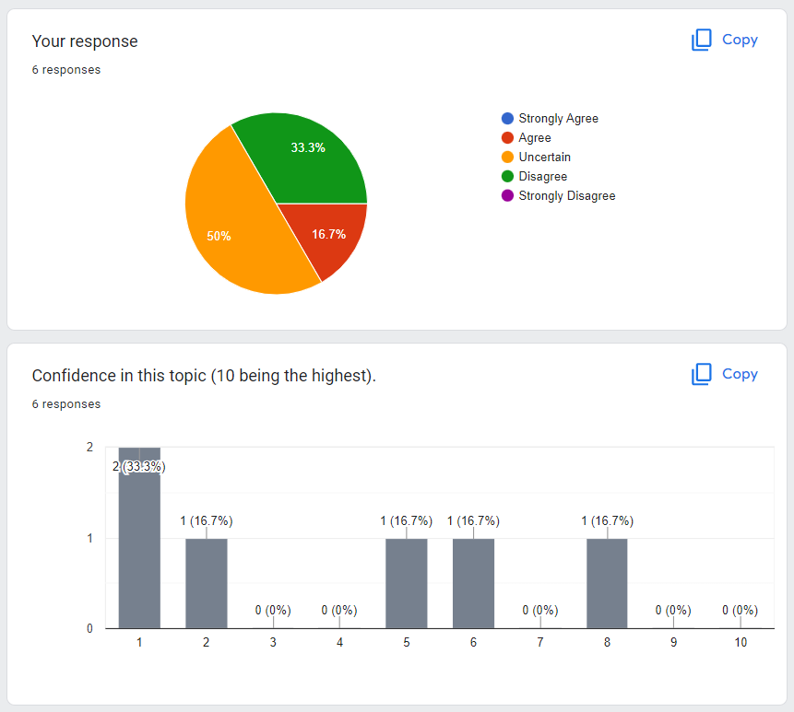

- For the second question, which asks whether realized returns on private equities measurly exceeded the returns on public equities since the global financial crisis, half of PhD respondents agreed while the IGM experts did not express strong opinions.

Question A

Although the reported volatility of asset values in private markets (private equity, buyouts, and venture capital) is lower than that of comparable assets in public markets, their true volatility is broadly similar or greater.

Select Explanations

- I believe that the right concept of “true” volatility should reflect the composition of demand for assets. Investors that buy and hold private equity shield its price from a multitude of other investors whose demand curves constantly shift up and down.

- Not quite sure what “true volatility” is getting at.

Question B

Since the global financial crisis, the realized returns on private equities have measurably exceeded the returns on public equities.