PhD Consensus Survey

Exploring PhD Students' Views on Vital Policy Issues

Banks and Financial Crises

Summary

- The PhD respondents were more skeptical than the economist respondents on whether banking research has made it possible to limit the damage from financial crises.

- Both sets of respondents were in unison in expressing uncertainty about the role of financial regulation reform since 2008 in reducing the probability of financial crises.

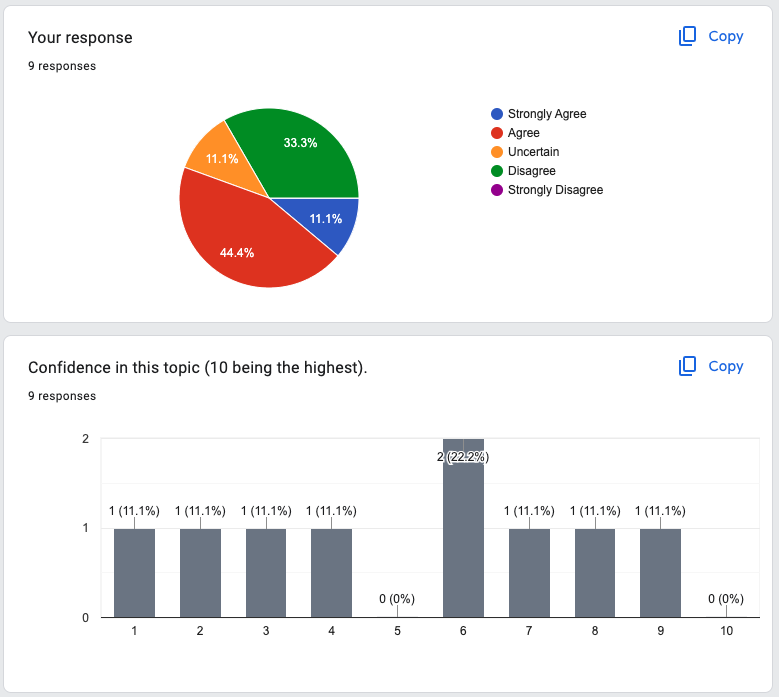

Question A

Research on the nature and impact of bank runs has made it possible to limit substantially the wider economic damage from financial crises.

Select Explanations

- We know we need something like narrow banks to prevent runs. But they don’t really exist anywhere.

- Following the GFC, a wealth of research sprung up on contagion and the network structure of the financial system. This seems to have formalized the vague notions that Bernanke and other found during the GFC: when banks are too connected, a failure can cascade and be catastrophic.

- Not sure if research has ex post justified measures to contain bank panics or if research helped inspire measures to contain bank panics

- Research into bank runs have led to more actions by policymakers to shore up banks and market confidence when necessary

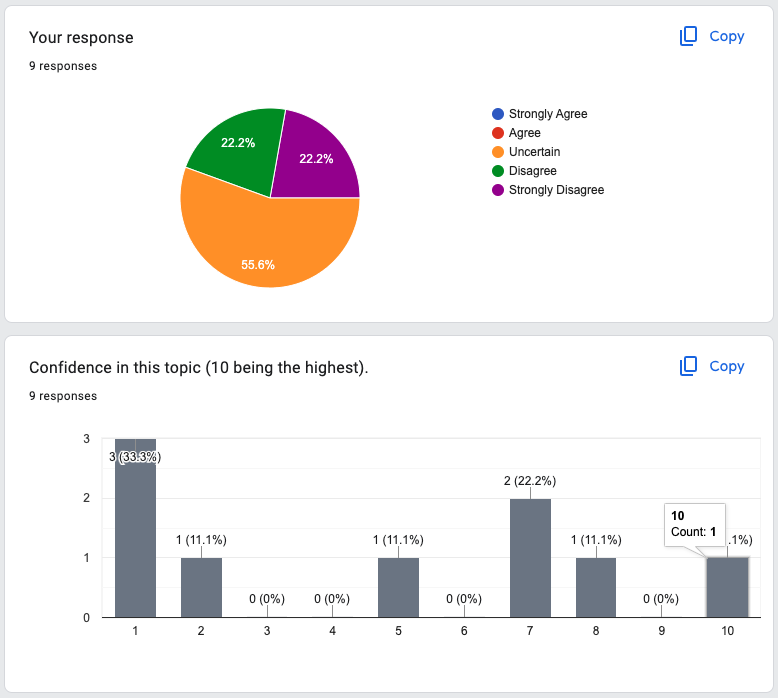

Question B

Reforms of financial regulation since 2008 (and macroprudential policies in some countries) will not substantially reduce the probability of financial crises.

Select Explanations

- Banks are better capitalized. But risks often appears in “safe” assets or shadow banking created by regulations.

- The issues of the GFC are clearly at the forefront of the policy discussion, and thus steps have been taken at not only the Fed, but also the Treasury to preempt having to resort to the drastic tools again.

- “Reforms since 2008” is a little tough for me to understand, as the reforms in question have gone in opposite directions

- Macroprudential policies?

- Many regulations, while well intended, may lead to negative externalities as banks take actions to meet capital requirements.